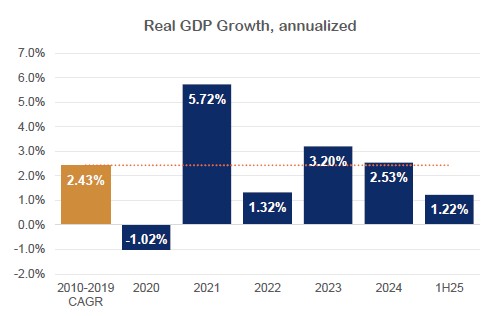

Long-time readers know that we have been cautious of a slowdown in consumer spending at a time when the consumer was the primary factor keeping the economy afloat. In hindsight, we were too early in that call: the consumer remained resilient much longer than expected, defiant in the face of rapid inflation. But this week’s GDP report suggests consumption has indeed slowed, growing at less than 1% annualized rate in 2025 versus 3% in each of the two prior years.

However, the rest of the economy (total GDP excluding private consumption) showed signs of recovery in the first half of the year, growing at a 1.8% rate versus 1.3% in 2024. The growth was driven by business investments in physical assets (3.4% vs. 2.2%) and intellectual property (6.2% vs 2.7%). The boost is consistent with bank lending data which shows commercial and industrial loan growth at four times the prior year’s growth (3.8% vs 0.9% in 2024)

In short, the economy is getting a much needed boost in sectors that have been less resilient since the COVID pandemic. And fortunately the rebalancing is happening at a time when consumer spending is slowing. Have we reached a turning point?

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years