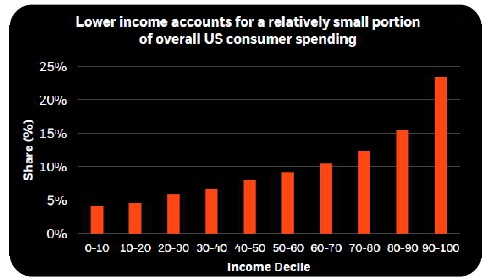

BlackRock recently offered an economic presentation to a group of institutional investors. The presenter highlighted a growing economic divergence: while aggregate data shows resilient household spending and balance sheets, this strength is increasingly concentrated in higher-income cohorts. The accompanying chart underscores this divide—lower-income households account for a disproportionately small share of consumer spending while facing the highest pressures from inflation, debt costs, and slowing wage growth. Meanwhile, wealthier households, insulated by asset gains and low-rate liabilities, continue to spend, invest, and drive aggregate metrics higher.

Looking ahead, AI adoption may widen this gap further. As firms boost productivity through automation, demand for routine and lower-skilled labor may fall—benefiting knowledge workers and capital owners while placing added strain on vulnerable workers. This shift could distort headline economic indicators, obscure underlying fragility, and challenge policymakers to respond to a labor market undergoing structural transformation.

For investors, understanding this bifurcation is critical to assessing risk, policy direction, and long-term asset allocation. Further, higher wealth concentration results in higher savings and investment rates, potentially increasing speculative behavior and raising the likelihood of asset bubbles.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years