U.S. consumer spending showed signs of resilience as the holiday shopping season kicked off. Black Friday results were solid, with online sales rising to $11.8 billion, a 9.1% increase from last year, according to Adobe Analytics. In-store activity also improved, though at a slower pace—up 1.7% year over year per Mastercard SpendingPulse. While inflation has moderated, consumers continue to show selectivity in their purchasing patterns, favoring promotions and digital channels as they balance spending with ongoing financial pressures.

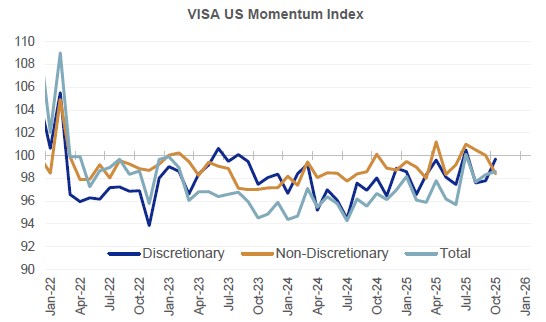

Visa’s U.S. Momentum Index, included in the chart, underscores this cautious consumer backdrop. Total spending remains below the neutral 100 level, indicating ongoing softness, but October marked the second consecutive month of improvement, suggesting potential stabilization. A notable shift is emerging beneath the surface: discretionary categories are showing comparatively stronger momentum than non-discretionary essentials, highlighting a reallocation of consumer dollars rather than broad-based spending strength. This mixed but improving landscape will be important for plan sponsors to monitor, as consumer behavior often influences corporate revenue trends, market sentiment, and ultimately participant retirement outcomes.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years