The ComperioAdvantage: Are Your Target Date Funds on Target?

The Environment

The popularity of target date funds has been on the upswing for the past 20 years. This trend accelerated when the 2006 Pension Protection Act identified target date funds as qualified default investment alternatives (QDAI) for sponsors choosing a safe harbor plan design.

Plan Sponsors adopting auto enrollment have also impacted the rapid growth of assets in target date funds.

According to Brightscope and the Investment Company Institute (ICI), over 80% of 401k plans include target date funds in their lineup. This trend also holds true for other defined contribution plans such as 403(b) and 457s.

A Target Date Fund (TDF) – also known as a lifecycle or age-based fund automatically adjusts its allocation mix of stocks, bonds and cash equivalents over time for the participant, based up on their expected retirement date. The TDF funds typically reduce their exposure to stocks as the timeframe gets closer to retirement, which is referred to as the fund’s glide path.

The Client

Regional Bank

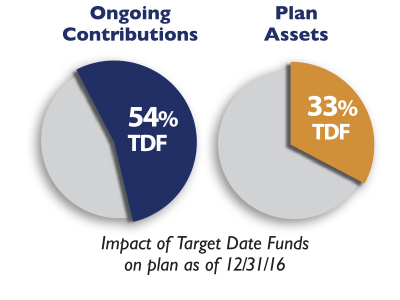

$44 million in retirement plan assets

1,300 participants

Average account balance $34k

Goals

- Ensure a formal prudent fiduciary process for evaluating and selecting target date funds (TDFs) that is well documented

- Create and implement an ongoing due diligence review process of the Plan’s target date funds

Approach

- Consider Plan characteristics

- Understand participant/employee population

- Review and agree upon the goals and objectives of the Committee

- Separately identify and document the goals and objectives for the target date fund

The Results

The Results

Comperio Retirement Consulting approaches the analysis of target date funds in a unique way compared to other investment options offered in the Plan. Our target date funds analysis process is customized and tailored to the Plan and participant’s needs and objectives. We spend the time to understand the plan demographics and analyze retirement outcomes for participants, based on plan design and demographics. Comperio then tailors its’ target date fund analysis to focus on these key objectives:

- Identifying the universe of target date fund families

- An emphasis on the target date fund glide path

- An analysis of each target date fund glide path

- Evaluation of the asset classes and the asset allocation

- Provide the Plan Sponsor with a documented process

The Results

The Results

Comperio Retirement Consulting approaches the analysis of target date funds in a unique way compared to other investment options offered in the Plan. Our target date funds analysis process is customized and tailored to the Plan and participant’s needs and objectives. We spend the time to understand the plan demographics and analyze retirement outcomes for participants, based on plan design and demographics. Comperio then tailors its’ target date fund analysis to focus on these key objectives:

- Identifying the universe of target date fund families

- An emphasis on the target date fund glide path

- An analysis of each target date fund glide path

- Evaluation of the asset classes and the asset allocation

- Provide the Plan Sponsor with a documented process

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years