A guide for choosing the right advisor

You have decided to hire an advisor for your plan. How should you judge whether or not the advisor firm has the appropriate expertise for your organization? Here are some qualifying questions that may help. Contact us for more questions.

1. Which type of fiduciary support can your firm offer?

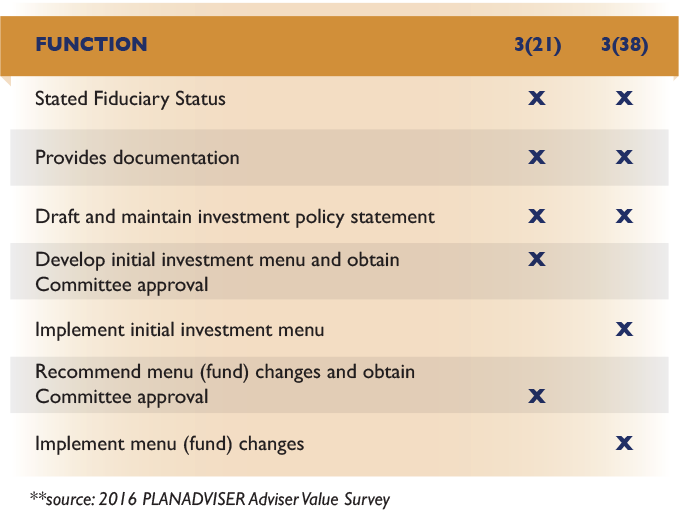

There are two main types of investment advisor fiduciaries with varying levels of responsibility for your plan. It is important that you understand what kind of service your advisor is offering:

3(21) Fiduciary: Retirement Plan Advisor will evaluate and prudently recommend specific investments to be offered as investment options to the Committee.

3(38) Fiduciary: Retirement Plan Advisor will evaluate and prudently designate the specific investments to be offered as investment options. An advisor has total discretion on the investment option selecting and replacement process. (See the chart below for more detail on these differences.)

- Fiduciary governance process

- Plan design

- Investment consulting

- Recordkeeping knowledge

- Negotiate fees with providers and recordkeeper

3. How does the advisor manage the investment menu selection process?

A fiduciary must act solely in the interest of the plan participants. This should include a rigorous approach to selecting and monitoring the funds in the investment menu.

4. Is the advisor able to work with any Recordkeeper and Third Party Administrator?

You want to select an advisor with experience working with many recordkeepers and TPAs across the industry. That kind of experience allows you to receive a more accurate view of all aspects of your plan but especially of the fees charged to your plan. You want a firm that has an in-depth knowledge of service providers’ fee structures, pricing strategies and service configurations.

5. What is the firm’s business model?

When you hire a retirement plan advisor, you should enter into a written agreement for services rendered. You want a firm that has no financial ties to any product or vendor. You should understand how much of the firm’s business is geared towards working with Plan Sponsors and how much of the firm’s revenue is generated through that work. Optimally, your fees should be reasonable and priced in a way that are transparent to the Plan Sponsor.

Below are resources we find valuable:

Pension Plan Limits

SEC Investment

Adviser Public

Disclosure

403(b) Resources

at AICPA

(American Institute of CPA’s)

Center for

Retirement Research

at Boston College

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years