The ComperioAdvantage: A Clearer View of Fees

The Environment

Regulatory pressures, legislative pressures, and even internal company pressures all have an impact on the Plan Sponsor. Recently, there has been a multitude of lawsuits regarding the appropriateness of fees paid by participants.

Fees are a complicated topic and even the most seasoned Plan Sponsor may be challenged to fully understand them. Plan Sponsors are held accountable not only to understand plan related fees but also to ensure that they are reasonable and transparent from an employee/participant perspective. There are three basic categories of plan-related fees:

- Administrative – recordkeeping, legal, trustee, participant communications and transactional related fees such as loan administration, account maintenance and QDROs fees among others

- Advisor/Consultant – these fees typically include fiduciary governance, fee negotiation, investment monitoring, plan design and education services

- Investment – investment management fees represent the largest allocation of plan expenses and are paid by employees through the expense ratio of the underlying investment

The Client

National US Law Firm

Retirement Plan Assets: $120 million

Number of ActiveParticipants: 500+

10 year relationship with current recordkeeper

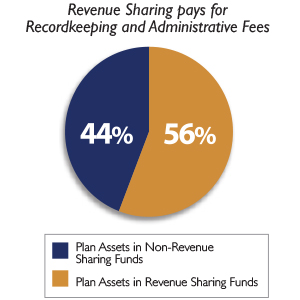

Pricing model is bundled with revenue sharing

Goals

- Quantify the actual annual plan administrative fees

- All participants share in a more equitable allocation of administrative fees

Approach

- Benchmark all recordkeeper, investments and advisor/consultant fees

- Negotiate plan fees directly with recordkeeper

- Ensure continued compliance with fee-disclosure rules

The Results

The Results

Comperio Retirement Consulting proprietary process and analysis of the plan resulted in:

- Lower annual administrative fees.

- Total fee transparency.

- Comprehensive documented fiduciary process.

- Equitable allocation of fees among all plan participants.

The Results

The Results

Comperio Retirement Consulting proprietary process and analysis of the plan resulted in:

- Lower annual administrative fees.

- Total fee transparency.

- Comprehensive documented fiduciary process.

- Equitable allocation of fees among all plan participants.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years