It is that time of year – when investment newsletters take a moment to look back and compare market performance relative to history. In typical Comperio fashion, we prefer to change the perspective, in hopes of adding additional insight to information you read elsewhere.

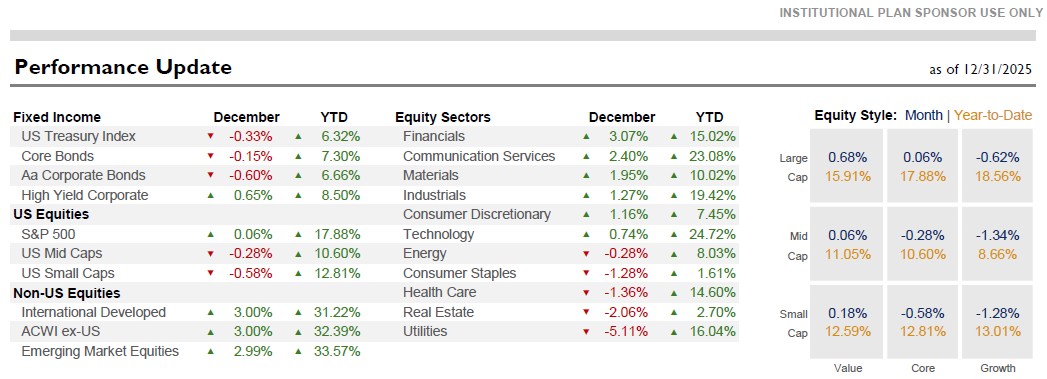

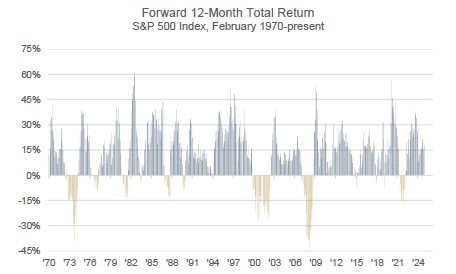

You may have read the S&P 500 returned 17.88% in 2025, its 26th best result over the past 55 years. A more useful view is knowing that an investor would earn 17.88% if they had invested in the S&P 500 at the end of 2024 and held the position for a full year. At that time, the investor would have expected a 12 month forward return of 12.54% with positive returns over 80% of the time (using a standard, naive approach to empirical forecasting). The chart on the right provides an historic view of forward returns (next 12 months) since the inception of the S&P 500 Index.

In the coming months, Comperio will introduce a more sophisticated, probabilistic approach to forecasting – one that is conditioned by insider sentiment (company owners & executives), credit market conditions, Federal Reserve monetary policy, and equity market valuations. Once introduced, the forecast indicator will become a standard fixture in the Comperio quarterly updates.

Mark your calendars for next month’s update: Insider Sentiment.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years