On-Going Consulting Fiduciary Processes

Comperio is dedicated to enhancing your fiduciary process, reducing company risk, and boosting your employees’ financial well-being. Our targeted deliverables and comprehensive service model are designed to elevate your fiduciary process mitigate risk and optimize your plan’s oversight process and success metric. Below are the specific components and our approach, aligned with key factors of fiduciary processes.

- Fiduciary Governance

- Investment Process

- Fee Structure

- Plan Design

- Participant Support

- Provider Management

Fiduciary Governance

- ERISA 3(21) / 3(38) Services

- Meeting Minutes

- Legislative & Regulatory Updates

- Fiduciary Committee Training

- Fiduciary File Management (Client Portal)

- Plan Sponsor Support

- Audit Support

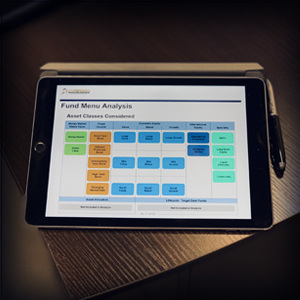

Investment Process

- Investment Policy Statement (IPS)

- Investment Selection & Monitoring

- Watch List Management

- Investment Due Diligence

- Investment Menu Offering Evaluation

- Stable Value Fund Due Diligence

- Target Date Fund Due Diligence

- Managed Account Due Diligence

Fee Structure

- Annual Fee Review

- Annual Share Class Review

- Fee Benchmarking (Investments, Recordkeeper/TPA & Advisor/Consultant)

- Fee Negotiation Proactively

Plan Design

- Annual Plan Design Consulting

- Plan Operations and Compliance Support

- Plan Design Benchmarking

- Employer Contribution Strategies

Participant Support

- Annual Communications Strategy

- Financial Wellness Due Diligence

- Participant-Level Fiduciary Advice

- Custom Employee Education Meetings

- Construction of a Retirement Tier Offering (Retention of Retiree Assets in Plan w/ a Payout Strategy)

Provider Management

- Vendor Search & Selection (RFP/RFI)

- Vendor Advocacy

- Conversion Support

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years