What are the odds Raleigh, NC sees 8–10 inches of snow? For any random weekend, the answer is essentially zero. Narrow the window to winter weekends? Still near zero. Even if meteorologists call for 8 10 inches? History says… still zero.

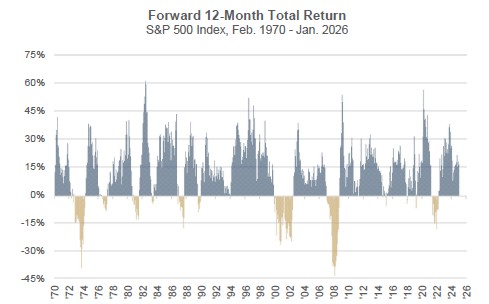

This is a lighthearted way to introduce a serious concept—conditional probability—and it frames the first installment of our multi-part series on using empirical data to identify market regimes {performance and/or risk conditions}. This month, we begin with insider sentiment, examining the collective actions of executives and owners of S&P 500 companies. While insiders sell for many reasons, they tend to buy for just one: perceived undervaluation. Can insider actions provide insight into market conditions?

By law, insiders are required to file a report of their transactions to the SEC. After analyzing more than 700,000 filings, the takeaway is clear: insider sentiment is a weak standalone signal, but at extremes it can help flag future market volatility. On its own, it is unreliable—but when layered with other conditions, it becomes useful. (This week, insider sentiment is neutral, rather than extreme, offering no useful insight.)

Next month: financial conditions.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years