Last week, the Commerce Department revised second-quarter GDP growth upward to 3.3% from 3.0%, with the modest boost largely reflecting stronger consumer spending. As we’ve noted before, the consumer has carried the economy through this cycle—remarkably resilient despite the Fed’s ongoing tightening. That resilience, however, is showing signs of strain. Labor markets are softening, credit card usage is slowing, and wage growth is normalizing. Inflation tied to the COVID-era surge has largely cooled (outside of financial services), but tariff-related price pressures are beginning to surface, adding another headwind.

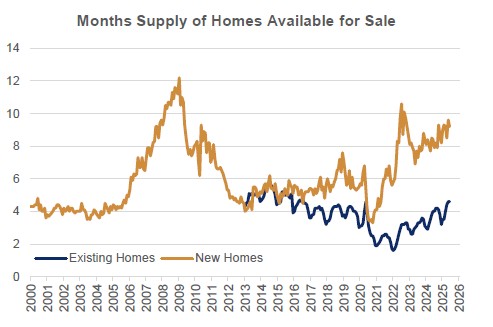

Housing is also emerging as a key drag on growth. Beyond its direct contribution to GDP through new construction and remodeling, housing exerts an outsized influence on consumer behavior through the “wealth effect.” In the decade leading up to COVID, housing typically added about 0.14% to annual GDP growth; in the most recent quarter, it subtracted 0.19%. Meanwhile, research suggests that every $1 increase in home equity can translate into $0.03–$0.20 of additional consumer spending. Unfortunately, the S&P Case-Shiller Index shows home prices declining for four straight months. At the same time, inventories of both new and existing homes continue to rise, pointing to further downward pressure on prices (see chart).

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years