On November 4, 2021, the IRS announced cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022. The Internal Revenue Code requires that the Secretary of the Treasury adjust the limits annually.

Some highlights are:

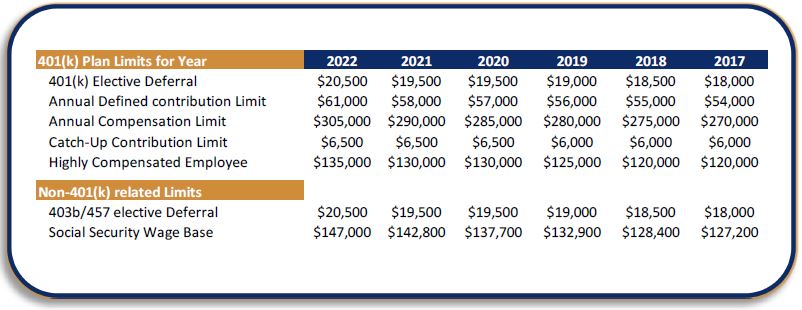

- The elective deferral (contribution) limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan will increase to $20,500.

- The catch-up contribution limit for those aged 50 and over will stay the same at $6,500.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years