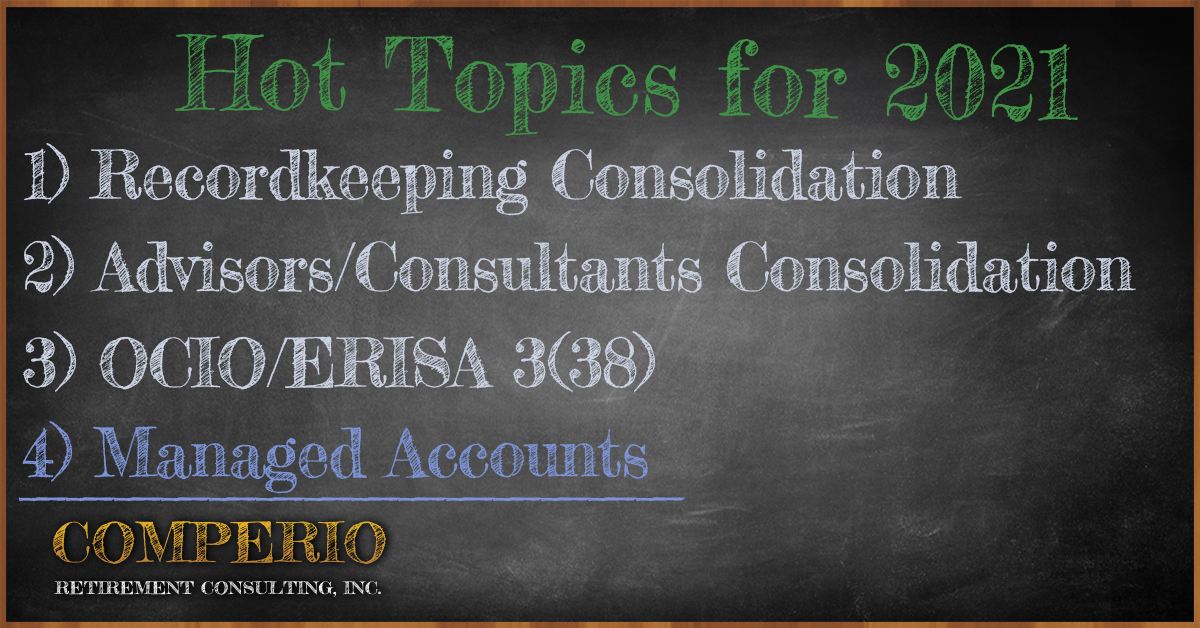

Managed Accounts

All 401(k) Plan recordkeeping firms are experiencing margin compression in their core business and seeking ways to increase their revenue in other areas, such as selling Managed Accounts.

It is critical that Plan Sponsors realize Managed Accounts are NOT a service but an investment product. Why the distinction? A Managed Account as an investment product means you have a fiduciary duty to conduct due diligence to evaluate the benefits.

As with any fiduciary decision, it is important for Plan Sponsors to utilize a formal due diligence process in analyzing the Managed Account option.

If your Committee has been proactively offered adding the Managed account to your Plan. Buyer beware! Make sure you have asked the questions above or contact Comperio to help in your evaluation. This is not a service, but a fiduciary decision and the risks lie with you the Plan Sponsor if you add this service blindly.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years