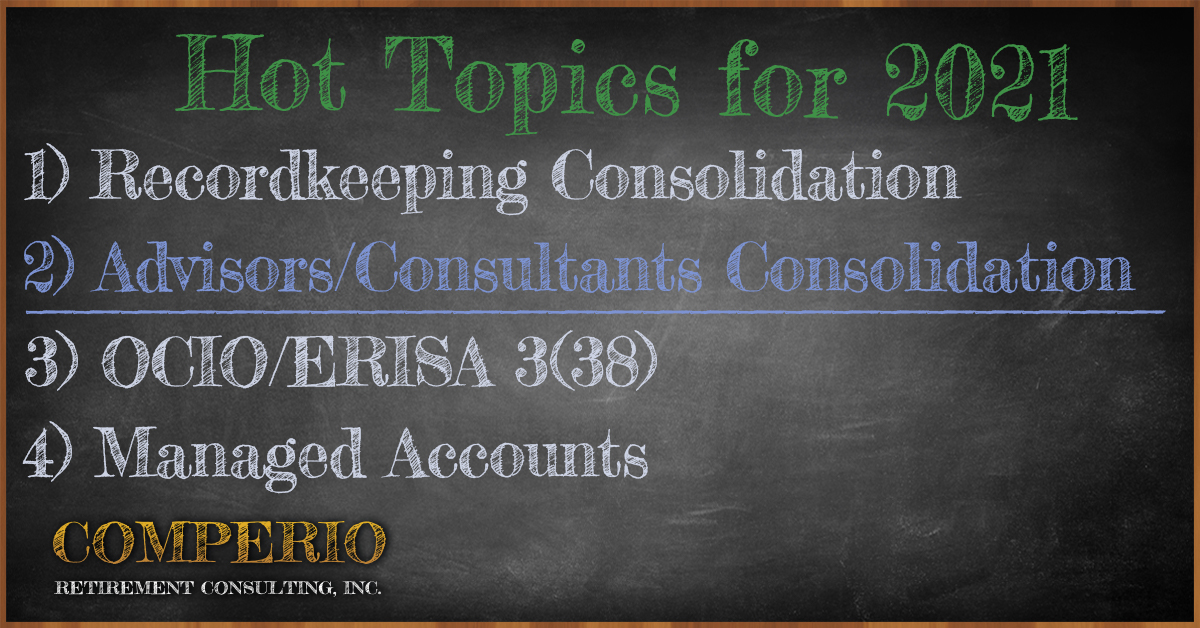

Advisors/Consultants Consolidation

The consolidation craze has made its way to the Retirement Plan Advisor/Consultant marketplace. Private equity firms, large financial services organizations and national benefits firms have all entered into agreements to acquire retirement plan advisory/consulting resources.

Examples include:

With 401(k) and other types of retirement plans becoming more complex, Plan Sponsors have become reliant on their advisor/consultant to provide unbiased advice.

The recent advisor/consultant consolidation is blurring the lines as firms, who were primarily focused on independent 401(k) consulting, have become part of larger financial service firms with expanded product lines and revenue requirements.

In order to satisfy fiduciary obligations, Plan Sponsors will need to understand the “service and product enhancements” that will inevitably be presented to them by various arms of these organizations and be prepared to evaluate any conflicts of interest that may arise.

Going forward, not only do Plan Sponsors have to understand recordkeeping consolidation and the products being sold to them, but they also have to buckle down and evaluate those same issues with these new advisor/consulting arrangements.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years