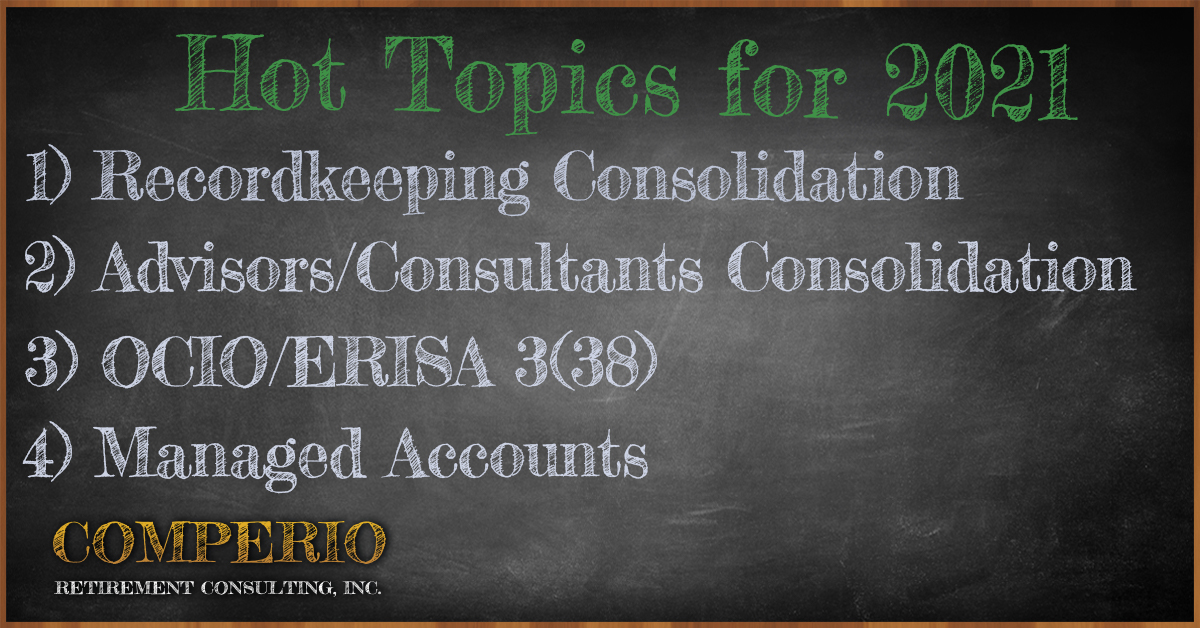

Recent changes continue to reshape the Retirement landscape due to Recordkeeper and Advisor/Consultant Consolidation. Plan Sponsors should be prepared to evaluate how these changes will affect their plans and participants.

Continued fee compression in 401(k) plan recordkeeping services is accelerating the need for economies of scale. Whether it is continued technological improvements, such as the adoption of cloud technologies or the need to offer a wider suite of services, recordkeepers are realizing they need to adjust or exit the business.

Perhaps the best example of this trend occurred in 2020 when Vanguard partnered with Infosys, Ltd. of India. Infosys has assumed operational control of the recordkeeping platform, including integrating all of Vanguard’s 401(k) operations employees and will be responsible for all future enhancements to the system.

A sample of other recordkeeping consolidation transactions include:

- Principal acquires Wells Fargo’s 401(k) recordkeeping busines

- Empower acquires MassMutual’s 401(k) recordkeeping business

- Ascensus and Empower acquire BB&T’s 401(k) recordkeeping business

- Newport Group acquires PNC Bank 401(k) recordkeeping business

It is imperative as a fiduciary to continually review and evaluate the services and fees delivered by your plan administrative/recordkeeping provider.

Some questions Committees should ask include:

- What changes to the existing level of service can we expect to see?

- Are there additional services that the recordkeeper will be trying to get our plan to adopt?

- How will the recordkeeper change the way they interact with my employees?

Evaluating your recordkeeper and the changes underway due to consolidation is critical in knowing how it will impact you and your participants. Change is on the way and you need to be prepared to ask the right questions or have a firm to support you in this process.

The consolidation craze has made its way to the Retirement Plan Advisor/Consultant marketplace. Private equity firms, large financial services organizations and national benefits firms have all entered into agreements to acquire retirement plan advisory/consulting resources.

Examples include:

- HUB International (insurance broker) buys multiple firms in 2019-20

- Goldman Sachs buys Rocaton

- Mercer buys Slocum

- Marsh & McLennan acquires Compass Financial Partners

- Aquiline Capital (owners of Ascensus) develops strategic alliance with SageView Advisory Group

With 401(k) and other types of retirement plans becoming more complex, Plan Sponsors have become reliant on their advisor/consultant to provide unbiased advice.

The recent advisor/consultant consolidation is blurring the lines as firms, who were primarily focused on independent 401(k) consulting, have become part of larger financial service firms with expanded product lines and revenue requirements.

In order to satisfy fiduciary obligations, Plan Sponsors will need to understand the “service and product enhancements” that will inevitably be presented to them by various arms of these organizations and be prepared to evaluate any conflicts of interest that may arise.

Going forward, not only do Plan Sponsors have to understand recordkeeping consolidation and the products being sold to them, but they also have to buckle down and evaluate those same issues with these new advisor/consulting arrangements.

When you collapse an accordion item and save, it will automatically display collapsed in front end

As this consolidation has occurred on the advisor side, Advisor firms are actively positioning OCIO (Outsourced Chief Investment Officers), ERISA 3(38) or Discretionary Asset Management services to Plan Sponsors. The three terms are used interchangeable and relate to hiring an advisor/consultant to take fiduciary responsibility from the Retirement Committee for all investment related decisions including hiring and firing investment managers/funds in your retirement plan.

Generally, Committees are utilizing this service due to:

- The desire for additional expertise in implementing institutional-quality structures,

- The perceived mitigation of fiduciary risk or

- An insufficient investment sophistication level on the Committee.

Plan Sponsors considering the implementation of this type of OCIO/ERISA 3(38) model should be prepared to conduct extensive due diligence on potential partners since there are significant differences in service models.

A small sample of questions that need to be addressed in detail include:

- Please explain the differences in the operation of the ERISA3(21) consulting versus your ERISA 3(38) consulting models.

- How is your team structured and who is responsible for making asset class decisions? Does the same team/individual make individual manager decisions?

- What due diligence do you provide us on the decisions you make for the Plan?

- How are fees structured and can we expect an increase by using the OCIO/ERISA 3(38)/Discretionary model?

- Do you utilize proprietary investment products or utilize an open architecture model?

- What oversight responsibilities do I have as a Plan Sponsor?

It is impossible for Plan Sponsors to eliminate all fiduciary liability and need to be prepared to undertake periodic due diligence of these services.

Determining whether the implementation of this type of service model will benefit the plan and participants is a big decision. Committees have chosen to hire an independent expert like Comperio on a one-time project basis to assist them in their OCIO/ ERISA 3(38) evaluation process.

All 401(k) Plan recordkeeping firms are experiencing margin compression in their core business and seeking ways to increase their revenue in other areas, such as selling Managed Accounts.

It is critical that Plan Sponsors realize Managed Accounts are NOT a service but an investment product. Why the distinction? A Managed Account as an investment product means you have a fiduciary duty to conduct due diligence to evaluate the benefits.

- Do I have written documentation on our decision to add a Managed Account option to the plan?

- Did the Committee review the investment process undertaken by the Managed Account provider?

- What are the fees for the Managed Account option?

- Is the recordkeeper’s advisory arm providing the Managed Account option and does this pose any conflicts?

- If there is a third-party advisor providing the Managed Account option Is the recordkeeper receiving compensation?

As with any fiduciary decision, it is important for Plan Sponsors to utilize a formal due diligence process in analyzing the Managed Account option.

If your Committee has been proactively offered adding the Managed account to your Plan. Buyer beware! Make sure you have asked the questions above or contact Comperio to help in your evaluation. This is not a service, but a fiduciary decision and the risks lie with you the Plan Sponsor if you add this service blindly.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years