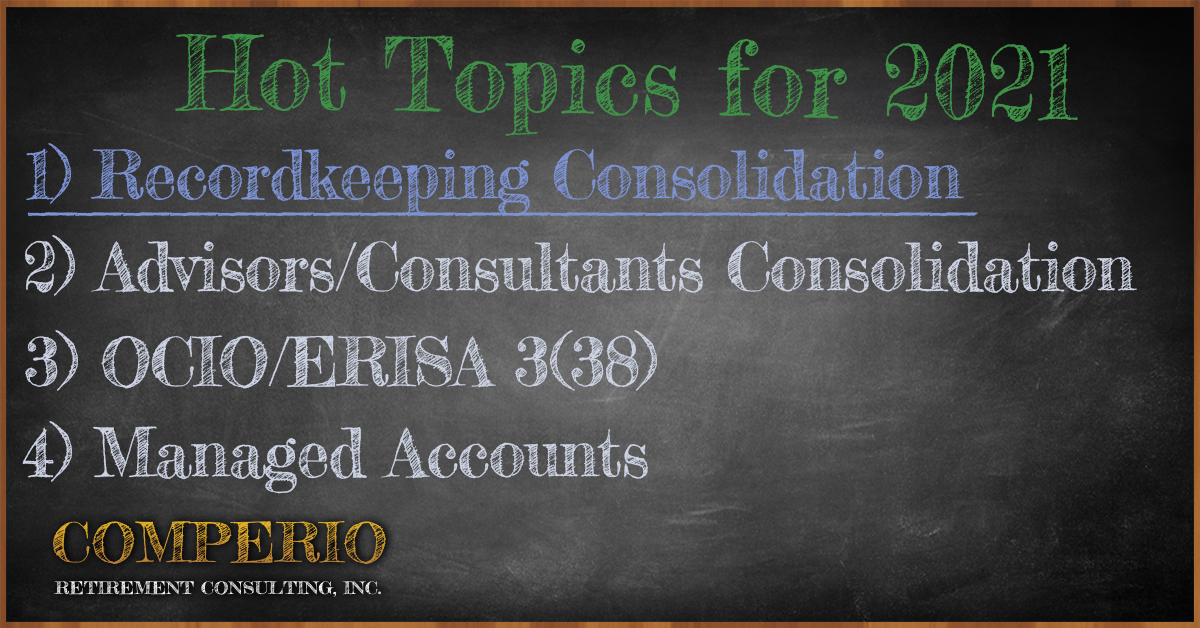

Recordkeeping Consolidation

Continued fee compression in 401(k) plan recordkeeping services is accelerating the need for economies of scale. Whether it is continued technological improvements, such as the adoption of cloud technologies or the need to offer a wider suite of services, recordkeepers are realizing they need to adjust or exit the business.

Perhaps the best example of this trend occurred in 2020 when Vanguard partnered with Infosys, Ltd. of India. Infosys has assumed operational control of the recordkeeping platform, including integrating all of Vanguard’s 401(k) operations employees and will be responsible for all future enhancements to the system.

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years