This past week, Fidelity® wrote about the likelihood of Fed rate cuts in 2024, despite higher

than expected inflation reports in January and February. We made a similar case to clients in

last quarter’s market update and felt the idea was worth repeating.

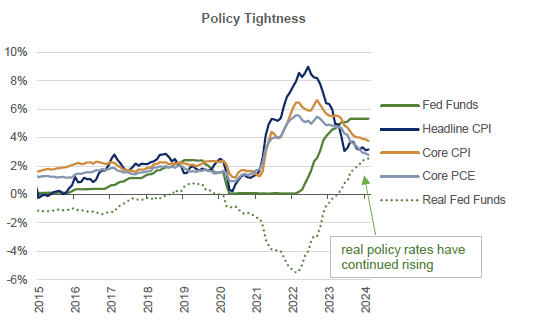

The Federal Reserve closely monitors a wide range of economic conditions when

determining its monetary policy. While inflation, labor conditions, and wage growth receive

significant attention, there’s an often overlooked factor: real interest rates (or real yields). Fed

Chair Jerome Powell has emphasized the importance of maintaining “meaningfully positive”

real rates.

But what exactly does this mean? Let’s break it down. A nominal interest rate consists of

two components: the real rate of return for holding an investment and an adjustment for

inflation. By dissecting the Fed’s policy rate, we can separate it into these two parts: real rates

and expected inflation. The chart illustrates this concept, with the solid green line representing

the actual Fed Funds (nominal) rate. Additionally, we consider three commonly cited inflation

measures: CPI, CPI excluding food and energy (“Core”), and PCE excluding food and energy

(often regarded as the Fed’s preferred gauge). Using the latter, we estimate the real rate

(shown as the green dotted line).

Despite the Fed halting rate hikes in late July 2023, real rates have continued to rise. From

0.9% at the end of July, they now stand at 2.55% as of the latest report—marking the highest

level since the onset of the Global Financial Crisis in 2008. Consequently, the Fed may need

to take action to prevent further increases in real rates.

Data source: Federal Reserve Economic Data, St. Louis Fed

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years