Gradually…then Suddenly

Warning: due to the rapidly evolving situation, this update will likely become outdated in a very short period of time. In a few short minutes after this article was written, the Fed announced $700 billion in asset purchases and cut the Fed Funds rate to 0% – 0.25%. And the governors of Ohio and Illinois mandated the closing of bars and restaurants indefinitely.

PLAN SPONSOR USE ONLY

March 15, 2020

It seems like just yesterday that we were hearing of another health scare “over there”, conjuring up memories of names like Sars, Zika, and Avian Flu. Then suddenly it was “here”. In the ensuing days, our inboxes at Comperio have been flooded with emails from our asset managers citing expert opinions – opinions that, at times, contradicted each other. While the situation continues to rapidly evolve, the staff at Comperio believes that it is time to provide you with an update on what we’ve learned so far.

WHAT IS THE CORONAVIRUS

First, what is COVID-19? We will leave the advanced health explanation to the epidemiologists but feel confident in sharing some of the basics. Coronavirus is a “family” of viruses – it’s not a unique name. COVID-19 is coronavirus disease of 2019. Much like the common cold, it is contagious and can easily be passed through direct contact with another person (even those who show no symptoms) and through indirect contact as the virus has been shown to survive on surfaces for extended periods of time. Many experts believe the virus may be seasonal – that warmer weather will slow the spread and allow health officials to find solutions before cooler weather allows the virus to remerge as others have in the past. Fingers crossed.

ECONOMIC IMPLICATIONS

What it means for the economy is hard to predict with accuracy. Unlike the prior outbreaks, we are seeing wide-ranging disruption of daily activity including the movement by many universities to virtual classrooms, large scale cancellation of events and temporary shortages of basic household items including cleaning products, toilet paper and paper towels. Just how fast is this evolving? We were on a call with a large global asset management firm to hear their view that a recession could be avoided despite a substantial slowdown in Q2. Literally as soon as the call ended, news outlets were reporting that same firm had flipped their view, that they now expect the slowdown to be steep enough to result in a recession for Q2-Q3. As data is being presented, new data is flooding in and forecasts are changing.

MARKET IMPLICATIONS

What this means for markets is even harder to predict. Traditional, fundamental analysis will tell you that it shouldn’t mean much over the long term. Your CFO’s can explain in great detail the impact of a short-term drop in business in a very (infinitely) long-term financial model. But sadly (or fortunately), that’s not how markets work. Markets can seem to be bi-polar, pricing in “irrational exuberance” only to flip to “extreme fear” in a matter of hours. Markets can also seem inhumane, rising in the face of widespread tragedy. What markets fear is uncertainty and that is where we are today. And we urge caution in making radical decisions in uncertain times. Our investment menus are designed to offer the benefits of diversification by featuring the relative safety of money markets (or stable value) and core bonds paired with the return generation of equities and other risk assets. The best recommendation going forward is no different than it has been in the past: diversify across sectors, regions, and asset classes.

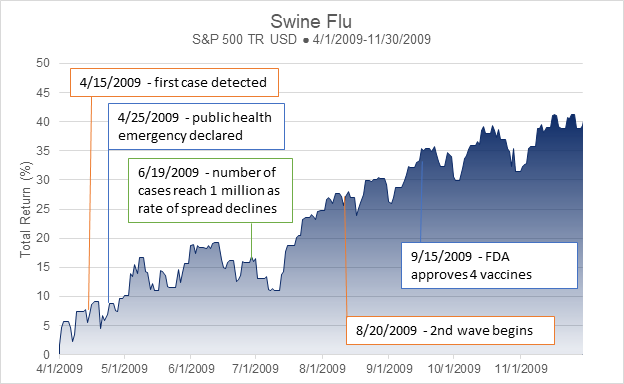

I want to contrast today’s market response to the current pandemic with the response to the Swine Flu in 2009. The Swine Flu (H1N1) was the worst pandemic we had faced since Polio was eradicated in the 1950s. Based on current CDC estimates, over 60 million Americans were infected with H1N1 during the initial 12-month period with over 150,000 deaths globally. Although not to the same extent as today, many quarantines were put in place to control the spread. And yet markets propelled higher. See the following chart.

Why did equity markets rise during the outbreak? A single factor cannot be cited as other critical elements were in play – namely the monetary crisis response by global central banks in the wake of the financial crisis. Attempting to trade the market on news of the pandemic would have proven difficult in 2009. What about today?

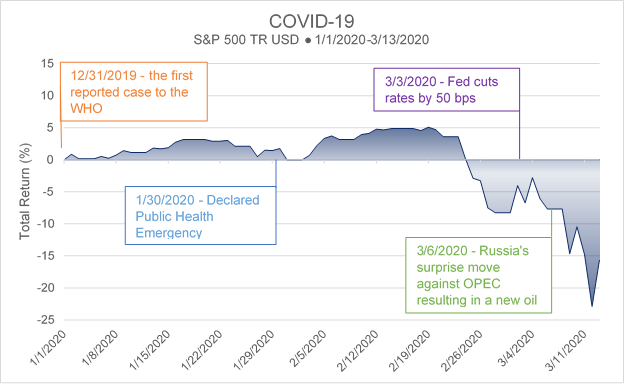

The following is a chart of the market this year during the outset of COVID-19. Notice how the market took the initial news in stride and strode higher just as it did in 2009. Early predictions were dire and news coverage was expansive. Why did markets continue to rise? Other factors were once again in play.

Markets seemed to digest the pandemic news with only modest difficulty – moving gradually day by day. Then suddenly, that changed. The weekend of March 6th a meeting between Russia and OPEC ended with a shock to the market. The expectation was the Russia, Saudi Arabia, and other OPEC nations would agree to oil production cuts in the face of the virus-caused economic slowdown. Not only did they not agree, Russia and Saudi Arabia signaled production increases would begin. Oil prices plunged and equity markets followed suit. (Other stresses in the dollar funding markets also ensued but those are too technically complex for this report.)

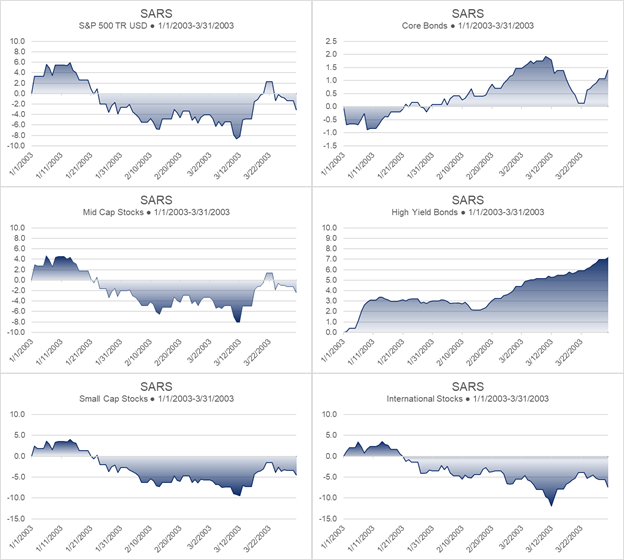

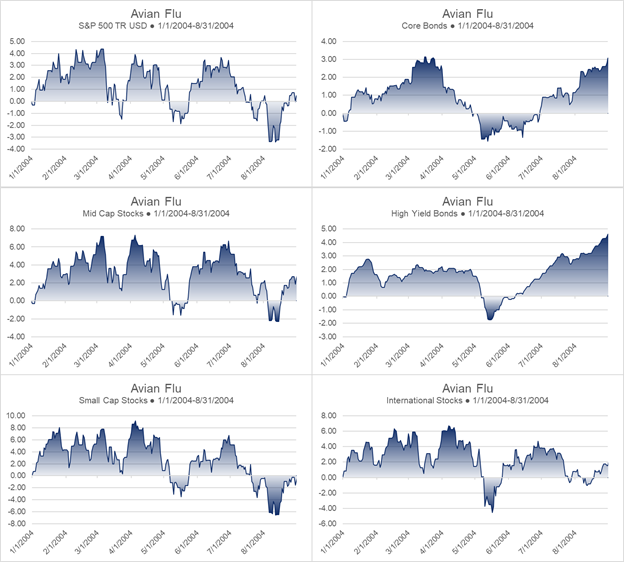

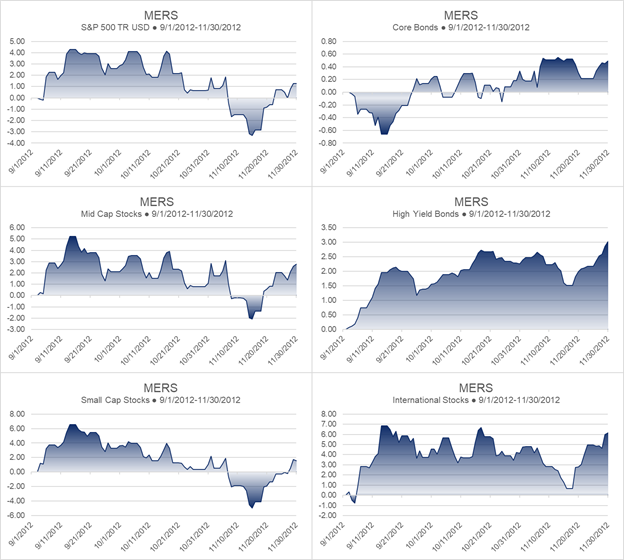

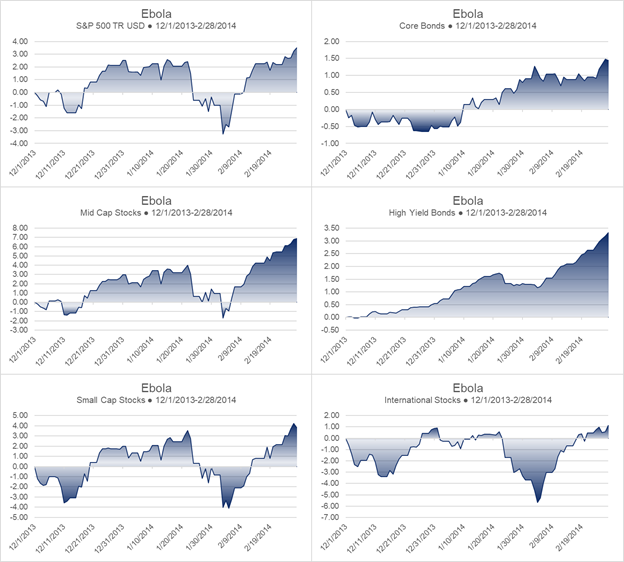

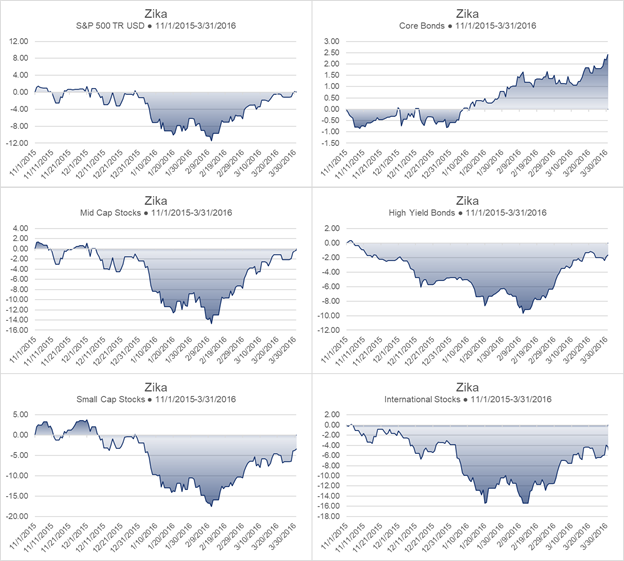

We can look at other pandemics to get an idea of how various asset classes reacted in the past which might give us a clue at how they may react in the coming months. As you will see, no two periods were the same but, in all instances, markets recovered within the following 12-months. Some markets followed a sharp “V” pattern which is commonly associated with economic supply shocks. Other times, markets followed a more prolonged “U” shape pattern which is associated with economic demand shocks. The consensus of managers we have spoken to are expecting a combination of supply and demand shocks.

IN SUMMARY

There are two key learnings to take from this report. First, many factors are at play in markets at all times, whether they dominate headline news or not. Attempting to time markets based on headlines can result in undesirable outcomes. Second, your retirement plan investment menus are constructed for various types of occasions – offering participants the ability to broadly diversify across asset classes. In times of stress, the best course of action is disciplined adherence to diversification and rebalancing.

CHARTS/COMPARISONS

PLEASE, take time to review the following charts. Notice how far equities have fallen and for how long. Also notice what is happening with Core Bonds (high quality bonds) and High Yield Bonds (higher risk of default).

Severe Acute Respiratory Syndrome (sARS)

Avian Flu

Middle East Respiratory Syndrome (MERS)

Ebola

Zika

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years

Comperio Retirement Consulting has been named one of the largest 100 Investment Consultants in the United States according to Pension & Investments (P&I) for the past 8 years